Custom Keto Diet Reviews

It goes without saying that all women want to be slim and healthy. But unfortunately, it is really hard to put to your diet and lead a healthy lifestyle when your everyday life is so busy and stressful. But a lot depends on your desire and your will! If you have a strong desire to lose weight, you can easily incorporate any diet into your lifestyle. For instance, if you check custom Keto diet reviews, you can see how many men and women have already lost weight and now feel happy about it! Let’s take a closer look at this diet plan and learn if it is worth your attention. We’ll analyze its key benefits and try to determine whether it is effective or not!

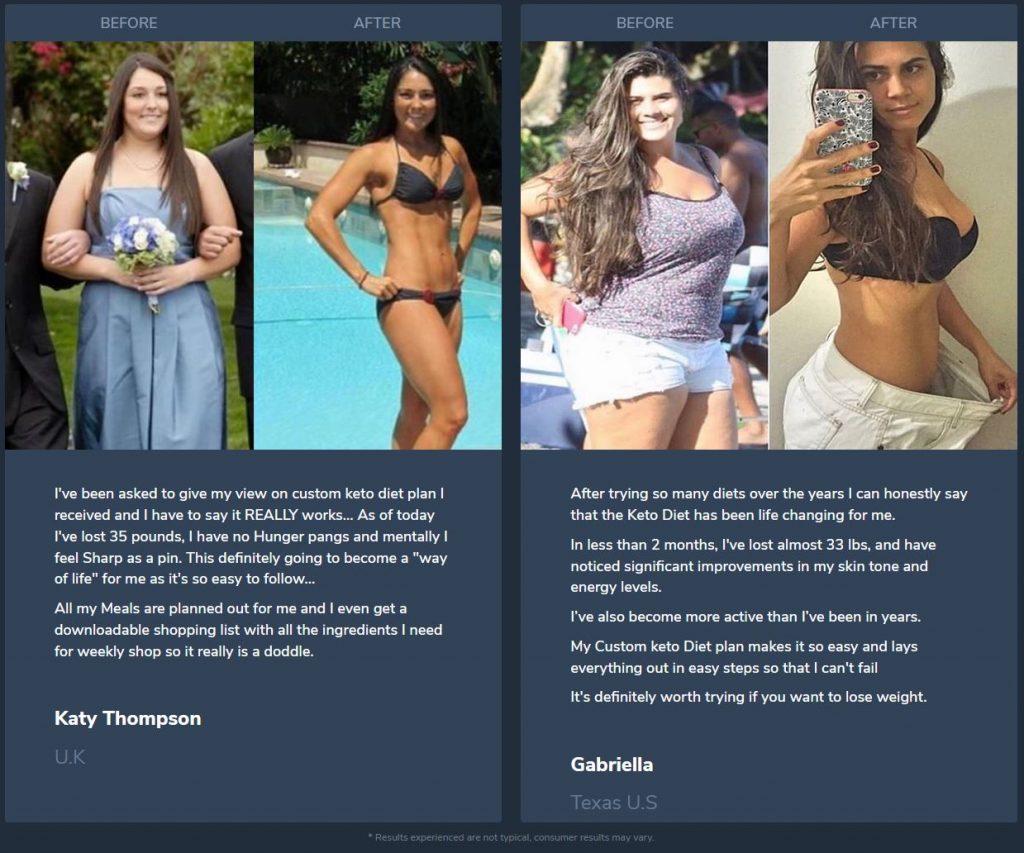

In fact, Custom Keto diet is a developed meal plan that allows millions of people who struggle with weight to lose a few kilos. By the way, this meal plan is very popular! You can check keto custom plan reviews of those who have already tested it, and you’ll see that many people have already experienced its positive impact on their bodies.

You can learn everything about keto, but you can’t build an effective meal plan yourself. It is really hard to properly calculate your micro and macro calories when you don’t know the basics. The main benefit of this diet is that it offers individual meal plans considering such information as your age, gender, height, weight, activity level, and your meal preferences.

Do you know what the main disadvantage of a conventional diet plan is? The thing is that they aren’t disruptive! That’s why beginners experience difficulties trying to understand its rules. They usually don’t take into consideration your age, sex, weight, or any other variables. Besides, most of them share basic information about food preferences, or portion size. Therefore, people who use it get confused, disappointed, and unmotivated. They don’t see the results and give up.

This is where Custom Keto diet jumps in! This meal plan has many thankful keto custom plan reviews and has already helped millions of people to get into good shape.

What’s a Custom Keto Diet Plan?

To put it simply, it’s an 8-week long meal plan that allows you to lose weight. The thing is that this plan is designed individually for a person including all variable factors that can influence weight loss procedure. Because of accurate carbs, fat, and protein calculations, this meal plan is probably the most effective solution for millions of people from all over the globe. This a customized meal plan that considers all your body needs. There’s no need to visit a dietician; you can do everything yourself!

No matter where you are; you can easily access a keto diet chart and follow its recommendations!

Who Needs a Keto Custom Plan?

Keto diet is not a new trend. It was developed a long time ago and already helped millions of people achieve their goals. But you probably wonder why you need a customized meal plan, when everything is available online and even for free. Let’s dig deeper!

Dieting is not easy. Sometimes, it is even harder than you might think. Successful dieting also requires planning that allows you to identify your objectives and find a practical approach that helps you achieve them. Simply put, it’s a systematic approach that enables you to achieve weight-related targets. On top of that, when using a customized meal plan, you’ll get detailed instructions on what you should eat and when.

Is Keto diet Meal Plan Effective?

To find out the answer to this question, let’s compare a personalized and a standard meal plan. When you download a standard meal plan online, you will only get the basic information about a diet. A customized meal plan follows all your needs, targets, and preferences. Therefore, when using a customized meal plan, you’ll see a result faster.

A personalized keto diet plan considers your weight goals, lifestyle, food preferences, daily activity, and other factors that can help you lose weight faster. However, you should understand that building a customized meal plan is not easy. It takes time, effort, knowledge, and expertise. But when choosing this option, you’ll get a customized meal plan that follows all your needs and preferences.

Sometimes people think that a customized meal plan includes recipes that are very hard to cook. But that’s an unsound opinion. In fact, all the recipes that are offered in a meal plan are straightforward. The ingredients are simple and you can buy them in any supermarket. You shouldn’t buy too expensive food items if you wish to follow this meal plan. On top of that, you’ll see the results in eight weeks!

In addition, you’ll also get the guidelines on food types, best eating patterns, and other pieces of advice from qualified dieters that will surely help achieve your goals faster.

What Is Inside Your Keto Plan?

You’ll get a detailed guide on how to lose weight. It’s a detailed meal plan that you should follow for eight weeks. Mind that you need to buy food and cook yourself. You only get the directions that are created based on the needs of your body!

It’s a detailed eight week program that includes a wide array of recipes. The main goal of this diet is to trigger your body into ketosis. As a result, your body starts losing weight on its own. No additional food supplements of physical exercises are needed. However, if you lead a healthy lifestyle, you can surely go in for sports.

What Are the Main Disadvantages of Custom Keto Diet?

Check all these keto diet plan reviews and you’ll see that it has a positive response from people who have already tested it. All these users have already lost a few kilos and see a drastic change in their body measurements. Overall, there are no disadvantages. Moreover, this meal plan doesn’t require starving, and there’s no need to refuse your favorite foods.

What Are the Main Advantages of a Custom Keto Diet Plan?

Let’s review the key benefits of this meal plan:

- This weight loss plan is a perfect solution for those who wish to lose weight quickly. For instance, if you want to slenderize quickly before an important occasion in your life, you will hardly find a better option than a personalized Keto Diet plan.

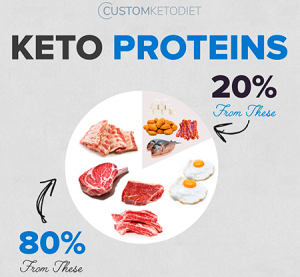

- It is based on only healthy food sources.

- You’ll get a comprehensive guide on how to lose weight quickly.

- You’ll get a detailed list of recipes that you need to cook every day.

- All these recipes will be personalized according to your preferences.

- You’ll have a full list for shopping.

- Your diet plan is based on your likings.

How to Receive Your Keto Diet Meal Plan?

You can order your 8-week weight loss plan from this website. Those who do this right now, will get a special discount. Its price is not sky-high as compared to similar products on the market. After you pay for this plan, you’ll get instant access to it and can start losing weight right away!

Summary

Overall, we’ve just provided you with a comprehensive keto custom plan review and analyzed its key benefits and disadvantages. Personally I have already tested it and can share superb results. It is very simple and easy to follow. You don’t starve and eat healthy and delicious dishes. Moreover, it can solve all the problems related to weight loss. You’ll surely see a good result after 8 weeks. If you want to further proceed with it, you can also ask for further customization of your personal meal plan.

Remember that your life is in your hands. If you don’t like how you look, no one but you can help you. Start changes right away. Below, you can find how to pay for custom keto diet plan. Order your personalized meal plan at a lower price today!

I got a detailed keto meal plan that helped me lose weight. Thanks, everything is easy and it really works.

I tried the ketogenic diet for 9 weeks and I finally can wear dresses that I couldn’t fit into for a few years! Awesome results!

You made some suitable points there. I viewed on the internet for the problem and also located most individuals will support with your website. Carolyn Ettore Cherilynn

Good respond in return of this issue with solid argumets and describing all concerning that. Kay Fletch Katerina

Way cool! Some very valid points! I appreciate you writing this post plus the rest of the site is also very good. Dori Rufe Adon